how to find bull flag stocks

Bull flags can be found on any time frame you use for trading. These 5 companies are set for historic price action.

A Market Signal Bull Flags Ascending Triangles And Ticker Tape

Anything less than that and you have a less bullish flag pattern.

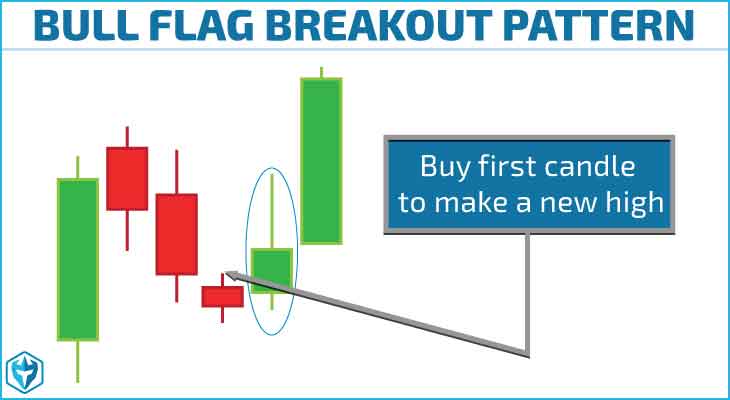

. From Novice To Expert Compare Brokers To Trade Stocks. In a bull flag pattern there needs to be a 90 price rise or more within a couple months before the horizontal consolidation. The bull flag pattern is one of the preferred setup traders like to use before the price of a security rises.

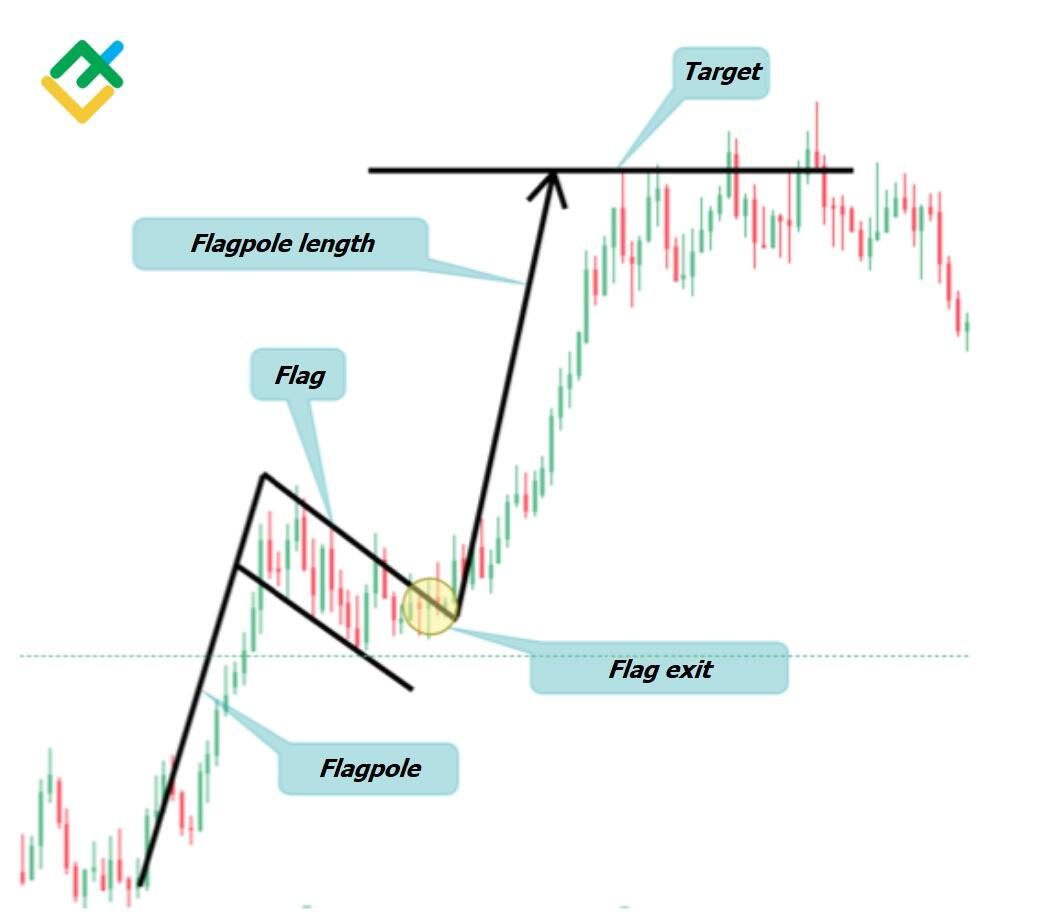

RUN IN STOCK SCREENER. Using Investar Stock Screener 1 Investar. The most important part of the flag pattern is to identify a strong trend in either direction as the Flag may be inverted.

Now is the time to move. It has the same structure as the bull flag but inverted. When you couple them with moving averages like the 9 and 20 exponential moving averages you can have a.

To trade this strategy on stocks with NSE you need the below setup to identify bull flag pattern while they are still forming. You may say its a bull. The Zacks Rank offers investors a way to easily find top-rated stocks and build a winning investment portfolio.

When the correction begins and the price drops. Ad Invesco has a diverse suite of commodity ETF products several commodity mutual funds. Look for an impulse move the pole of the flag in price.

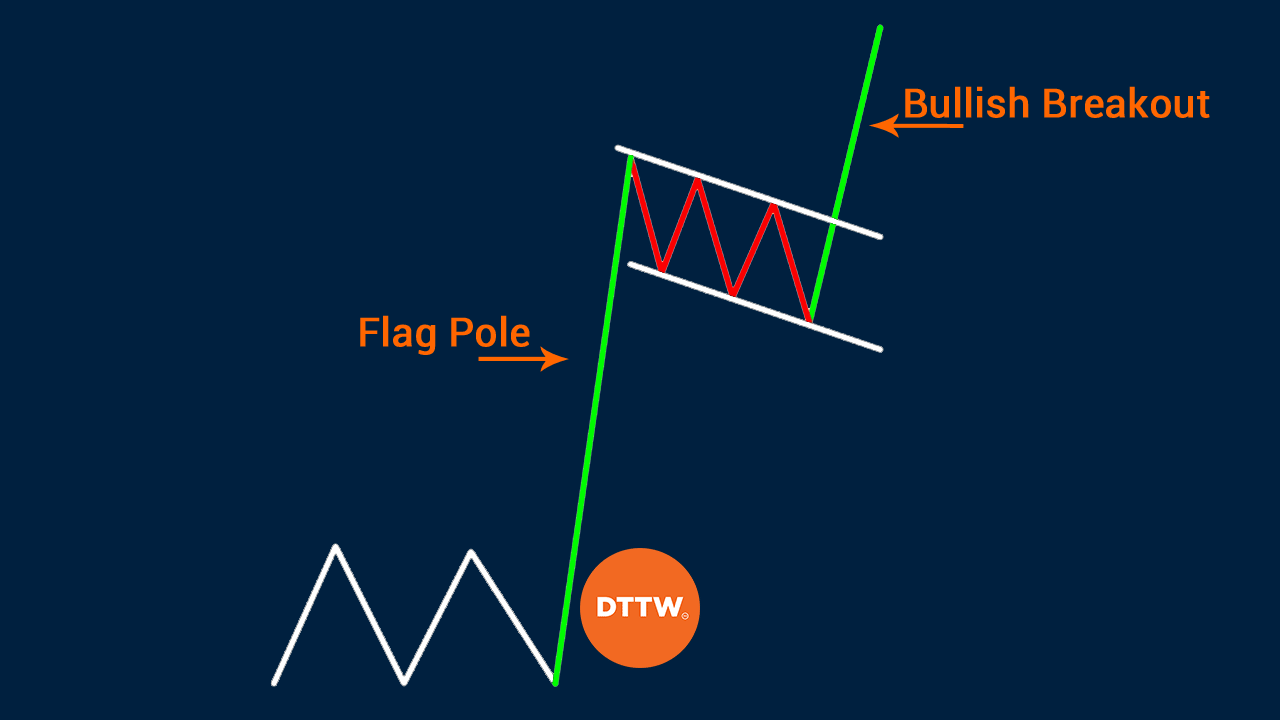

A bull flag pattern is a bullish trend of a stock that resembles a flag on a flag pole. Heres why you should take advantage. Covered Calls Naked Puts Bull.

Ad Nonstop Trading Innovation. You can use a stock screener such as Finviz to help you find bull flags occurring in stocks. The Bull Flag and Volume.

Trading volume is an additional key element in identifying a bull flag. How to Trade a Bull Flag Chart Pattern Step 1. The potential benefits of pivoting to commodities may help against inflation.

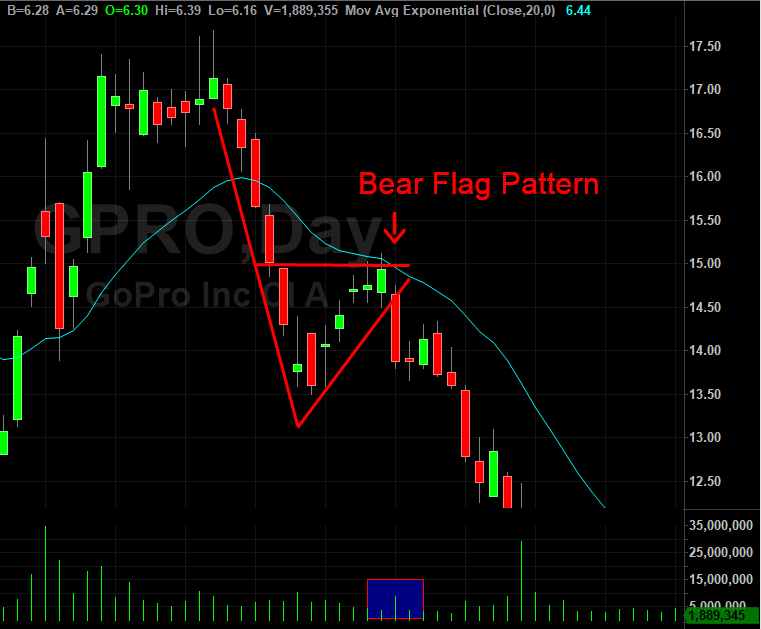

The bear flag is an upside down version of the bull flat. Ad A rare market phenomena could change everything and theres no telling when it will occur. The bull flag should have an uptrend since its a continuation pattern and isnt a reversal.

The flagpole forms on an almost vertical panic. Hey everyone what are your thoughts on this type of video. Ad New Experienced Investors Should Consider These Top-Recommended Stock Trading Platforms.

This pattern is one of the simplest to spot on a price chart and the. A bull flag is a technical continuation pattern which can be observed in stocks with strong uptrends. The stock history shows a sharp rise which is the flag pole followed by an up.

Today we talked about screening stocks and finding good bull flag patterns. A bull flag pattern is a bullish continuation pattern used in technical analysis that occurs in a market that is in an uptrend. Ad Nonstop Trading Innovation.

722 This screen finds bull flag patterns. Our Top Picks For Stock Brokers. Stay tuned for my 3 st.

What Is Bull Flag Pattern How To Identify Points To Enter Trade Dttw

Bull Flag Chart Pattern Trading Strategies Warrior Trading

Bullflags Education Tradingview

How To Trade Bullish Flag Patterns

Bull Flag Chart Pattern Trading Strategies Warrior Trading

Bullish Flag Chart Patterns Education Tradingview

How To Trade Bull Flag Pattern Six Simple Steps

How To Identify A Bull Flag In Real Time Conditions The Daily Hodl

Learn About Bull Flag Candlestick Pattern Thinkmarkets En

Learn Forex Trading The Bull Flag Pattern

What Is Bull Flag Pattern And How To Use It In Trading Litefinance

Bull Flag Vs Bear Flag And How To Trade Them Properly

Bull Flag Chart Pattern Trading Strategies Warrior Trading

How To Trade Bull Flag Pattern Six Simple Steps

How To Trade Bullish Flag Patterns

Bullish Flag Chart Patterns Education Tradingview

:max_bytes(150000):strip_icc()/dotdash_Final_Flag_May_2020-01-337783b3928c40c99752093e6cb03f6d.jpg)